Farm Succession Planning: What You Need to Know

When you own a farm, your hard work isn’t just for yourself, but also for your family. Many farmers aim to pass their business down from generation to generation. In fact, over 70% of U.S. farmland will change hands in the next 20 years, according to the National Institute of Food and Agriculture.

But without farm succession planning, there’s no guarantee that your hard work will survive an ownership change. Here are some tips for establishing a successful farm succession plan so your family can continue the legacy of your land.

A farm succession plan lays out what will happen to a farm when current owners leave, whether that’s due to death, retirement, disability, or something else. The plan explains who will take over and when. It may also lay out the financial process for legally transferring over the farm; for example, whether the new owners will be purchasing the farm directly from the current owner or receiving it as an inheritance.

Without farm succession planning, this transfer can get a lot messier—especially if you depart unexpectedly. Instead, you want the next generation of farm owners to know exactly what’s going to happen after you leave.

According to the Conway Center for Family Business, about 30% of family businesses survive past the first generation of owners. Setting up a farm succession plan is crucial if you want the farm to last beyond your ownership.

Besides protecting your farm’s future, succession planning also creates financial benefits for you as the current owner. A succession plan may include terms for how you would transfer the farm to the new owners, say, through a buyout. You’d come to an agreement with the future owners for how much you’d receive, and that payout can help fund your retirement.

A discussion about succession planning may even boost farm morale because the future owners, who might be key employees, will know they are taking over one day. This will keep them motivated to grow the farm and reduce the chance that they leave for other opportunities.

Finally, farm succession planning may help reduce the tax impact of transferring the farm to others. Depending on how you plan to transfer ownership, there are several taxes you could encounter, such as estate taxes and capital gains. By preparing early, you may come up with a structure that minimizes these taxes, versus scrambling last minute when there are fewer avenues available to avoid a major tax hit. Consult a personal tax preparer for advice based on your situation.

Before you begin your succession plan, consider that there are two key parts of a farm: the farming business and the land itself. The business generates active income from your work, whereas the land is a valuable asset that could be sold or rented.

If your intent is to pass both the business and the land to the same person or group of people, then you may just need one plan. But if you want to divide the business from the land, say, to give pieces of land to heirs, two plans could help eliminate any confusion or strife among the successors.

Professionals like an attorney, financial planner, and even a succession advisor can help you decide if two succession plans are necessary, iron out the details, and help with appropriate documentation once you’ve considered the following questions:

A study of Iowa farmers found that only 49% had named a successor. If you haven’t named one yet, decide: Will it be one person, or will you divide ownership between several? If it’s several, how will you divide up the ownership stake?

You may want to come up with a backup plan, too, in case the first new owner you pick doesn’t want to run the farm or passes away before the transfer of ownership.

Family members and other heirs who’ve left the farm might not be positioned to take over the business, but you might decide to leave them some of the land as an inheritance. This is an example of when two succession plans could be necessary.

Are your successors inheriting both the business and land? Or do you want a select group of heirs to continue your farming work, where others receive property as an inheritance?

Succession plans on the business side should include a detailed list of assets, such as machinery, feed, livestock, and other valuable property owned by your farm. You should also state whether the new owners will be responsible to pay existing farm debt or if you will keep that responsibility.

When planning for land inheritance, be explicit about the specific parcels you want for each heir. If successors will receive both the business and the land, they’ll need information on all of the above.

Explain when you’d like the farm succession plan to begin. Do you want it to be at a set date in the future, or would you prefer it to be based on events, like the day you decide to retire? Consider if you want to live on the farmland in retirement; if so, land inheritance could occur later than the business.

Don’t forget to list contingencies for when the transfer should take place earlier, like if you suddenly pass away, get diagnosed with a critical illness, or suffer from a major injury. Sadly, the Social Security Administration notes that more than 1 in 4 people will become disabled before they reach retirement age, so the chance of these contingencies is real.

Your plan should likely explain exactly how you will legally transfer farm ownership to the next generation. If there are multiple business heirs, what percentage of the business will they receive? Will those taking over farmland buy it from you or receive it as inheritance?

This is where you bring in experts to ensure your plan is financially and legally sound. Keep reading for details about these professionals and how they’ll help your succession plans.

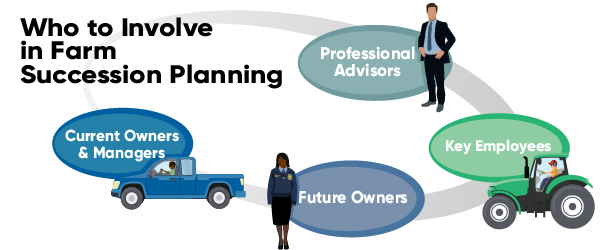

When you establish a farm succession plan, there are a few groups that should be included in the discussion. First, any other current farm owners and managers. Even if you’re the majority owner and have the right to decide everything yourself, you’re still making decisions that will impact the future of other stakeholders, so you want to make sure they’re engaged. Otherwise, they might be resistant to transfer and unwilling to support the future owners.

You should also discuss your plan with the future owners of the farm business and land. Make sure they agree with the terms of the succession, like the values of the assets and timeline for transfer of ownership. Learning about the succession plan will also keep them motivated to work hard and build the value of the business and/or land they’ll take over one day.

If you have any key farm employees who will not become owners, you may want to explain the plan to them as well so they feel confident there’s still a future for them there, even after you leave. You may also consider a financial incentive, like an extra bonus, if they stay on after the transfer. This could make up for their potential disappointment about not becoming owners.

Finally, you should bring in relevant professionals to work out the financial details in your plan. An accountant who can explain the potential tax impact of the various ways to transfer the business is vital. You should also consider using a family business attorney to help formalize your succession plan with the future owners and draft any necessary contracts.

Last, if you’re planning on selling the farm to the future owners, you should consider consulting a business valuation specialist to come up with a fair market value for your farm, and use the valuation to guide any negotiations.

Before your farm succession plan is finalized, be sure to consider these potential pitfalls that may prevent you from successfully executing your wishes.

The farm depends on your leadership, skills, and network to be successful. If you weren’t there tomorrow, would your staff still be able to run everything properly? If not, take time to train the future management team so they understand how to run the farm on their own. This should include introducing them to key suppliers, clients, and other partners, and starting to include them in meetings that could be beneficial for their understanding of the business.

The Iowa survey previously discussed also found that almost 70% of farmers do not have adult children currently working on their farm. If your goal is to have your children take over the business one day, bring them onsite to teach them what you know. They’ll inherit not only the farm, but the knowledge they need to help it thrive.

A lot can happen in the time between when your farm succession plan is drafted and when the transfer is actually executed. The value of your farmland could rise; you may expand into new crops and services; you could buy more land and machinery. These changes could mean your original succession plan is no longer appropriate and needs to be updated with new information.

If you have designated several people to take over the farm, it’s possible some will be unhappy about the way you split things up. As you divide up the farm, consider basing this decision on fair and measurable factors, like years of experience, job title, and anticipated investment in the farm. This can help you justify why some future owners will receive more in the plan than others.

In addition, if you leave some of the land to heirs who have never been involved in the farm business, there may be some frustration to contend with. According to the USDA, an acre of farmland in the U.S. was valued at $3,160 in 2020 on average, and values continue to rise. Consider how you will balance your goals of leaving an inheritance against the hard work of those who kept the farm running over the years.

Even if you’ve identified reliable future owners for your farm, you may want to prepare in case their circumstances change. Perhaps your top candidate decides they no longer want to stay in the business or runs into health issues that force them to step down.

You should consider how that would impact your succession, whether that person’s share would be divided amongst the rest of the management team, or if you would bring on a new successor. To avoid disagreements, you may want to name a mediator—or another neutral third party—who can help you with difficult discussions.

Transferring ownership of a farm is a major financial transaction that involves its own set of special issues. If the succession plan isn’t structured properly, it could lead to more taxes for yourself—and your heirs—during the transfer. Planning ahead with farm succession experts can help you structure the transfer specifically to minimize taxes.

Another issue might be if you and the future owners don’t agree on the value of the farm business or land. This is where attorneys and valuation specialists can step in to help with documentation.

To minimize potential disagreements about the value of the farm at the time of transfer, consider addressing any debate among the new ownership as soon as possible. These disagreements are much more difficult and stressful to resolve at the last minute, and may cost you some of your hard-earned money.

Just writing out a farm succession plan is already a big step in the right direction. But your plan likely will be most successful if it is as detailed as possible. Consider all the questions on this list, and clearly document all of your answers. Bring in professionals as needed, and be sure that current and future owners understand the steps to succession along with what they’ll need to do once the plan begins.

For more guidance on farm succession planning, consider the Transition and Estate Planning resource from Iowa State University, which compiles many valuable documents for both farmers and your heirs.

If you need to find professionals to help with your plan, start with your state bar association to find attorneys specializing in agriculture law and succession planning. You could find an accredited financial planner through the National Association of Personal Financial Advisors, and appraisers through the American Society of Farm Managers & Rural Appraisers (ASFMRA).

Once your farm succession plan is in place, review it regularly to ensure it reflects the current reality of your farm and see if any changes are necessary to keep a successful transition of power in place. By making a detailed succession plan, you’ll plant the seeds of success for the next generation.

Download our free succession planning worksheet to start the process.

Get free template

Find the latest tips, expert insights and product information for corn farmers.

Visit Corn Herbicides HQThe information provided herein is provided gratis, and solely as reference. The information is not intended to be, nor shall it be a farmer’s sole and exclusive source of information on the subject matter. Corteva Agriscience makes no warranty, or other representation, express or implied, as to the accuracy of any information contained herein, and cannot assume responsibility or liability for reliance on or use of this information by any farmer in making specific decisions on succession planning, which in all cases is the responsibility of the farmer.